Realty Cash Flow Investments: A Overview to Structure Steady Income

Property capital financial investments have long been a favorite for capitalists seeking regular earnings streams while building wide range. Unlike traditional supply or bond investments, realty uses tangible, income-producing buildings that can supply monthly or quarterly returns. If you're seeking to start or boost your portfolio in property cash flow financial investments, this guide covers the essentials, kinds of cash flow residential or commercial properties, and strategies to optimize returns.

What Are Realty Capital Investments?

Cash flow in realty describes the earnings a property generates after accounting for expenditures like home mortgage payments, real estate tax, insurance policy, and maintenance expenses. Positive cash flow financial investments happen when rental income exceeds costs, leaving capitalists with profit. Numerous sight property cash flow as a secure and foreseeable means to gain income, whether through domestic rental properties, commercial structures, or various other kinds of income-generating realty.

Why Consider Realty Capital Investments?

Steady Earnings Stream

Cash flow investments offer routine revenue, which can be reinvested, made use of for costs, or saved. Unlike supplies, which depend heavily on market conditions, rental revenue tends to continue to be more steady, making it suitable for risk-averse capitalists.

Tax Benefits

Capitalists can gain from tax obligation reductions, such as devaluation, home loan rate of interest, and property-related expenditures, which can minimize gross income.

Recognition Potential

In time, home values often tend to value. This twin advantage of recognition and capital can develop a robust investment chance that develops wealth over the long term.

Control and Tangibility

With real estate, you have control over building management decisions, tenant option, and improvement options, giving even more control over cash flow than traditional investments.

Kinds Of Property Capital Investments

Single-Family Leasings (SFRs).

These are standalone properties rented out to individuals or households. SFRs are normally less complicated to take care of, extra cost effective for new financiers, and have a tendency to attract longer-term lessees, decreasing turnover prices and vacancy prices.

Multi-Family Residences.

Multi-family residential or commercial properties consist of duplexes, triplexes, and apartment. These buildings use the advantage of several income streams from a single property, which can improve cash flow capacity and mitigate job risks.

Business Realty.

This includes office complex, retail areas, and commercial residential or commercial properties. Industrial leases are often lasting, providing stable income and normally moving some maintenance sets you back to lessees, which can improve capital margins.

Trip Services.

Temporary leasings like vacation homes or Airbnbs can supply substantial income, specifically in high-demand locations. Although they may call for much more active administration, the prospective capital can be high, particularly in popular vacationer locations.

Mixed-Use Characteristic.

Mixed-use residential properties incorporate residential, commercial, and sometimes even retail spaces. These residential or commercial properties take advantage of varied income streams and can grow in areas with high foot web traffic or city appeal.

Trick Techniques to Make The Most Of Capital.

Place is Trick.

The residential property's location is just one of the most vital determinants of rental demand and home admiration. Focus on locations with low vacancy prices, high rental need, and future development capacity.

Reliable Building Monitoring.

Handling expenditures and maximizing rental revenue can make a considerable difference. Employing a reliable property supervisor, remaining on top of repair services, and establishing affordable rents can boost capital.

Frequently Review Rental Rates.

Guaranteeing rental fees go to or slightly over market degrees assists take full advantage of income while maintaining occupants satisfied. Performing regular rent testimonials and comparing with neighborhood market rates ensures you're not leaving cash on the table.

Optimize Lending Terms.

Funding terms can impact capital considerably. For example, choosing a loan with a reduced interest rate or a longer amortization duration can lower regular monthly payments, enhancing net capital.

Decrease Vacancies.

Keeping turnover prices reduced https://sites.google.com/view/real-estate-develop-investment/ helps maintain regular cash flow. Treating occupants well, supplying motivations for revivals, and ensuring smooth building management can reduce openings prices and turnover expenses.

Consider Value-Add Investments.

In some cases tiny restorations, like upgrading kitchens or bathrooms, can enable you to charge greater rents and enhance tenant fulfillment. These value-add enhancements can result in higher cash flow with reasonably low ahead of time costs.

How to Calculate Cash Flow in Property.

Before spending, it's essential to recognize just how to compute cash flow:.

Gross https://sites.google.com/view/real-estate-develop-investment/ Rental Earnings.

This is the total income the residential property generates from rent and any added costs (e.g., pet dog costs, parking).

Operating Costs.

Consists of all monthly costs associated with the building, such as real estate tax, insurance policy, maintenance, monitoring costs, utilities, and repairs.

Debt Solution.

The monthly home loan payment, that includes principal and passion.

Web Operating Earnings (NOI).

Subtract operating expenses from the gross rental earnings. This figure represents earnings before debt solution.

Capital.

Lastly, deduct the financial debt solution from the NOI. If this number is positive, the property has a favorable cash flow, which suggests it's producing profit.

Instance Calculation:.

Gross Rental Revenue: $2,500/ month.

Running Expenses: $500/month.

Financial obligation Service: $1,200/ month.

NOI = $2,500 - $500 = $2,000.

Cash Flow = $2,000 - $1,200 = $800.

In this example, the capitalist would make a month-to-month capital of $800.

Threats in Real Estate Capital Investments.

While property cash flow financial investments can be profitable, they feature some dangers:.

Vacancy Real estate cash flow investments Danger.

Expanded openings can harm capital, specifically in areas with high tenant turnover or seasonal need. Appropriately assessing rental need can alleviate vacancy threats.

Upkeep Prices.

Unexpected repairs or high maintenance costs can eat into profits. Developing a maintenance get and planning for regular repair services is vital for long-term sustainability.

Market Fluctuations.

Realty markets can be intermittent, and home worths may rise and fall. While capital can remain constant, downturns in the marketplace might impact appreciation possibility.

Tenant-Related Concerns.

Managing tough occupants, late payments, or residential or commercial property damage can strain capital. Proper renter testing and routine home checks can aid alleviate these dangers.

Tips for Beginning in Property Cash Flow Investments.

Start Small.

Newbies may locate single-family leasings more convenient and affordable. Beginning small enables you to gain experience without frustrating monetary dedications.

Collaborate with Experts.

Seek advice from realty professionals, including realtors, property supervisors, and financial advisors, that can supply valuable understandings and help you make informed choices.

Educate Yourself.

Learn about real estate fundamentals, tax benefits, and local markets. Attending seminars, joining realty investment groups, and checking out reputable resources can be helpful.

Hold your horses.

Building a cash money flow-positive property profile takes some time. Staying regular, learning from experiences, and reinvesting earnings can produce substantial returns over the long term.

Property cash flow financial investments provide an effective means to generate steady income while building lasting wealth. By choosing the best residential or commercial property kind, making the most of capital strategies, and meticulously determining potential returns, you can develop a rewarding portfolio that satisfies your financial objectives. Whether you're interested in single-family services or commercial properties, realty capital investing can be a trustworthy asset for developing financial safety and passive earnings.

Richard "Little Hercules" Sandrak Then & Now!

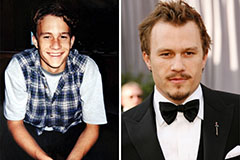

Richard "Little Hercules" Sandrak Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!